Feb 17, 2026

-

Ani Gottiparthy

Of the 500,000 deals we analyzed in 2025, the primary competitor was a named vendor in fewer than half of them.

In 55% of deals, the thing standing between a rep and a closed-won was not a funded competitor with a pricing page you can scrape. It was a spreadsheet. A ChatGPT workflow someone built in an afternoon. An internal tool the data team put together two years ago. A Notion doc that's "good enough for now."

The status quo. Indecision. The unnamed competitor.

And almost no competitive programs treat it like a real competitor.

Competitive Rate Varies More Than You'd Think

Before getting into the fix, it's worth understanding why this happens, because the answer tells you something useful about your own situation.

Competitive rate -- the share of deals where a named vendor shows up -- varies enormously across companies. We have customers where it's above 90%. We have others where it's below 40%. Same category of "compete program," completely different actual problem.

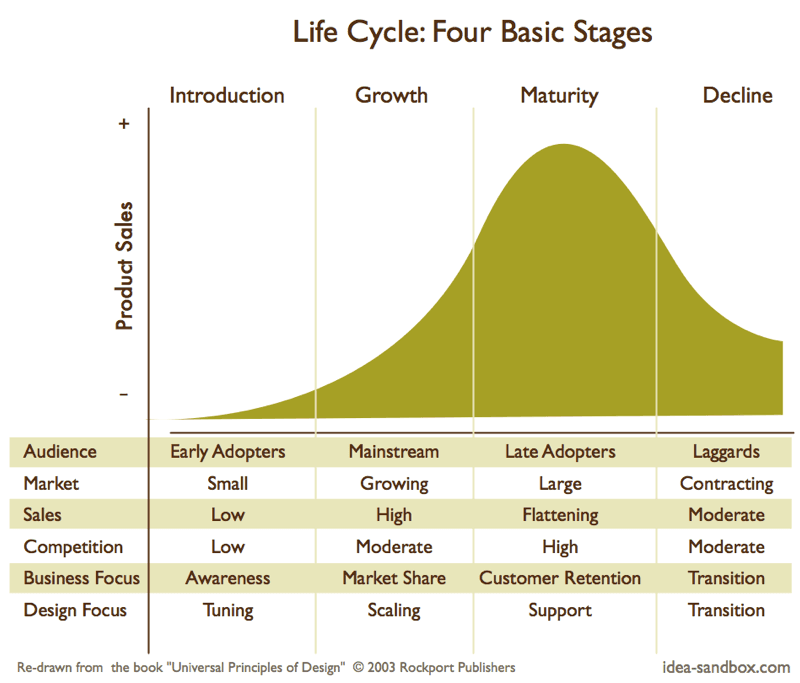

The variable that explains most of the difference is category maturity.

In nascent or emerging categories, buyers don't have a prior vendor to replace. They have a spreadsheet, a manual process, or nothing. The entire sales motion is about creating a category belief and building urgency around inaction. Early conversational intelligence, early revenue intelligence, early PLG tooling -- before these markets had named incumbents, they were almost entirely competing against status quo. The compete program for these companies, if it exists at all, should be almost entirely focused on the unnamed competitor.

In mature, competitive categories, that flips. Buyers already have something, and the job is displacement. CRM, marketing automation, HRIS -- most deals in these categories have a named vendor in the field. The compete playbook was basically written for this situation.

Most companies sit somewhere in the middle, which means they have both problems at once -- and the ratio tends to break by segment. Enterprise buyers often lag SMB on category adoption by a few years, so you'll see a higher named competitor rate in enterprise and a higher status quo rate in your SMB or mid-market motion. If your competitive rate breaks significantly by deal size, that's not noise. It's a signal about where your category has matured and where it hasn't.

The practical implication: a company in an emerging category that builds a compete program focused entirely on named vendors is optimizing for the wrong thing. And a company in a mature category that keeps writing losses off as "no decision" is probably avoiding hard truths about why they're losing head-to-head.

Almost all the compete content written for PMMs -- battlecard templates, win-loss frameworks, positioning guides -- assumes you're in the mature-category situation. There's almost nothing for the other half.

Why This Category Is Getting Harder to Ignore

For a long time, "no decision" felt like a pipeline problem, not a compete problem. The prospect just wasn't ready. Time to move on.

But that framing has quietly stopped being accurate. Prospects who used to have no alternative now have a credible one: they can ask ChatGPT. They can spin up a workflow in an afternoon. They can stitch together three free tools over a weekend and call it a solution. AI has given buyers a genuinely lower-friction option for a wide range of workflows, and it is landing in your deals.

If your compete program only covers named vendors, you are building a fence around the wrong part of the yard.

The Core Mistake: Treating Status Quo as One Thing

Here is where most teams go wrong when they do think about this category. They treat "no decision / status quo" as a single monolith and try to build messaging around it. The result is vague and unusable: "communicate value," "build urgency," "focus on ROI."

Reps don't lose deals to "status quo." They lose deals to specific things:

A senior AE who has been running the team's reporting in Excel for three years and has no incentive to change it

A founder who built an internal tool and is proud of it

A RevOps lead who just started using ChatGPT for the use case and thinks it covers 80% of what you do

A VP who is "interested" but has no compelling reason to move before Q3

Each of those is a different competitive situation. The discovery questions that work on the Excel scenario don't work on the ChatGPT scenario. The proof points that land with the internal-build audience don't resonate with the person who just doesn't feel urgency yet.

The fix is specificity. Bucket your no-decision losses by what the prospect is actually doing instead of buying, then run a normal compete sprint on each bucket.

How to Actually Build a Compete Program for This

The structure is the same as a named competitor program, with a few important differences in tone and emphasis.

What you keep: Discovery questions, objection handling, win/loss themes, proof points, triggering events. All of it still applies.

What you drop: The competitor profile, the feature comparison table, the "quick dismissals" designed to plant doubt about a named product. There's no product to attack here.

What you add: A triggering events section. With named competitors, a deal can move whenever the rep creates enough urgency. With status quo deals, you are often waiting for something to change in the prospect's world -- a leadership hire, a painful incident, a forecast miss, a team scaling past the point where the current workflow still works. Reps need to know what those signals look like and how to accelerate when one appears.

Where to put your energy: Discovery. The entire job in a status quo deal is helping the prospect articulate their own pain clearly enough that they can justify the change internally. Reps who pitch features against a spreadsheet lose. Reps who ask the right questions and help a prospect quantify what their current process is costing them win.

For each bucket, your recipe looks roughly like this:

Pull your no-decision / closed-lost deals from the past 90 days and tag by what the prospect was doing instead

Find the top two or three buckets by frequency or by low win rate

Pull transcripts and loss notes from those deals and look for patterns: why did they stay, what did we miss in discovery, what finally tipped the deals we won

Build a battlecard per bucket with the sections above

Brief the field and revisit quarterly

The ChatGPT Factor

Worth calling out specifically: AI assistants are the fastest-growing bucket we're seeing in deal data right now. The "we'll just use ChatGPT for this" objection is landing in categories where it would have been laughable 18 months ago.

The compete approach for this bucket is different from the spreadsheet bucket in one important way: prospects who choose ChatGPT are often technically sophisticated and optimistic about AI generally. The frame of "here's why that tool isn't good enough" tends to backfire. The better frame is specificity and reliability -- what does your product do that a general-purpose AI tool cannot do consistently, at scale, and with the accountability their organization actually needs.

That is a winnable conversation. But it requires a dedicated battlecard, not a generic "build urgency" talk track.

A Template to Get Started

A PMM in the PMA Slack community recently asked whether anyone had ever built a battlecard for the status quo competitor, and whether a normal compete format even made sense for it.

We put together a template based on the structure above, with a companion Hindsight Recipe that auto-populates each section from your deal data. If you want to build this out for your team: [link].

One card per bucket. Start with whichever shows up most often in your losses. The field will use it.